#Portfolio optimization

Explore tagged Tumblr posts

Text

This $0.175 Altcoin Has Solana (SOL) and Ethereum (ETH) Investors Reconsidering Their Portfolios

Rexas Finance (RXS) draws interest from investors who once mostly supported Solana and Ethereum. Now valued at $0.175, this new altcoin is being praised as a digital asset revolution. Particularly as the token’s explosive climb continues, Rexas Finance is making investors rethink their portfolios with its creative approach, cutting-edge technologies, and fast-developing ecosystem. Rexas Finance…

0 notes

Text

Modern portfolio management companies focus on optimizing investments through strategic asset allocation, risk management, and diversification. They utilize advanced technology, provide personalized financial solutions, and ensure regular portfolio monitoring and rebalancing. These companies emphasize transparency, ethical practices, and adapting to market trends to meet client needs while driving financial growth.

#portfolio management#investment strategies#asset allocation#risk management#financial planning#diversification#portfolio monitoring#investment solutions#transparency#modern portfolio#market trends#financial growth#portfolio rebalancing#ethical investments#personalized finance#wealth management#investment goals#advanced technology#market analysis#portfolio optimization

0 notes

Text

what is Non-linear machine learning optimization

Non-linear machine learning optimization focuses on finding optimal parameters for models with complex, non-linear relationships between inputs and outputs. It uses techniques like gradient descent, genetic algorithms, and simulated annealing. These methods are vital for tasks like image recognition and natural language processing, ensuring improved model performance and accuracy.

#Non-linear machine optimization#Machine learning optimization techniques#Complex problem-solving#Objective functions#Constraints in optimization#Neural networks optimization#Supply chain optimization#Portfolio optimization#Quadratic and exponential functions#Local minima and maxima#Resource allocation optimization#Computational complexity in optimization#Real-world applications of non-linear optimization#Flexibility in optimization models#Operational efficiency#Production line optimization#Integration with third-party tools#Challenges of non-linear optimization#Algorithms for non-linear optimization

1 note

·

View note

Text

Is Six Flags Selling Some of Their Theme Parks Post-Merger?

Recently, there have been significant developments in the amusement park industry, particularly concerning the newly formed Six Flags Entertainment Corporation. Following the merger of Six Flags and Cedar Fair, which was completed on July 1, 2024, the newly integrated company has announced an initiative known as Project Accelerate. This initiative aims to enhance operational efficiency and guest…

0 notes

Text

Diversifying your investment portfolio is key to managing risk and achieving long-term financial goals. Learn effective strategies for asset allocation, geographic diversification, and sector allocation to optimize your investment returns. #InvestmentPortfolio #Diversification #RiskManagement

0 notes

Text

Machine Learning in Finance: Opportunities and Challenges

(Images made by author with MS Bing Image Creator ) Machine learning (ML), a branch of artificial intelligence (AI), is reshaping the finance industry, empowering investment professionals to unlock hidden insights, improve trading processes, and optimize portfolios. While ML holds great promise for revolutionizing decision-making, it presents challenges as well. This post explores current…

View On WordPress

#clustering#Finance#financial data analysis#kkn#machine learning#ml algorithms#nlp#overfitting#pca#portfolio optimization#random forests#svm

0 notes

Text

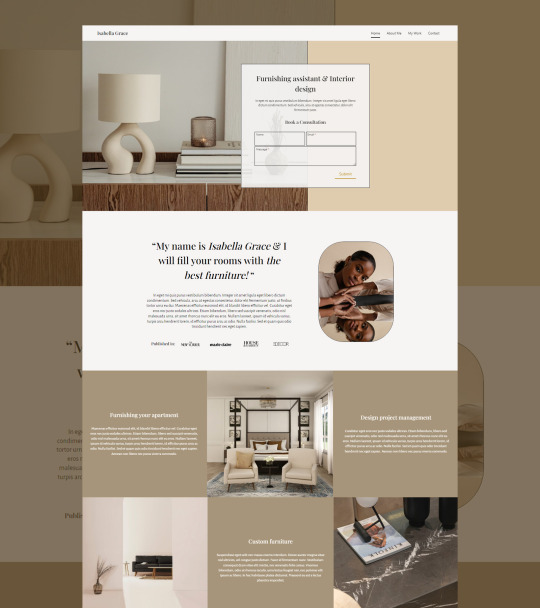

Web Design by Alice | Interior Designer portfolio

#web design#webdesign#aesthetic web design#web design by alice#interior designer#portfolio building#mobile optimization#websitedesign

73 notes

·

View notes

Text

As a dedicated freelancer with expertise in Translation, Data Entry, MS Word, Excel, PowerPoint. I have a years of experience delivering high-quality results to clients globally. My skills include SEO, Translation languages, Data Entry. I prioritize clear communication, timely project completion, and client satisfaction. Let's work together to bring your project to life!

Key Expertise:

1.SEO Expert

2.Local SEO

3.Translation

4.Data Entry

Why Choose Me:

1.High-quality work

2.Strong attention to detail

3.Reliable and professional communication

#new profile photo#digital marketing#seo#seo expart#local seo expart#translation#data entry#search engine optimization#social media marketing#socialmediamarketing#local seo#seo services#portfolio#profile picture#new profile pic

3 notes

·

View notes

Text

Unveiling the Best SEO Worker in Bangladesh: Driving Digital Success

#https://dev-seo-worker-in-bangladesh.pantheonsite.io/home/: With years of experience and a deep understanding of search engine algorithms#[Insert Name] possesses unparalleled expertise in SEO strategies and techniques. They stay abreast of the latest trends and updates in the#ensuring that clients benefit from cutting-edge optimization practices.#Customized Solutions: Recognizing that each business is unique#[Insert Name] tailors their SEO strategies to suit the specific needs and goals of every client. Whether it's improving website rankings#enhancing user experience#or boosting conversion rates#they craft personalized solutions that yield tangible results.#Data-Driven Approach: [Insert Name] firmly believes in the power of data to drive informed decision-making. They meticulously analyze websi#keyword performance#and competitor insights to devise data-driven SEO strategies that deliver maximum impact.#Transparent Communication: Clear and transparent communication lies at the heart of [Insert Name]'s approach to client collaboration. From#they maintain open lines of communication#ensuring that clients are always kept informed and empowered.#Proven Results: The success stories speak for themselves. Time and again#[Insert Name] has helped businesses across diverse industries achieve unprecedented growth in online visibility#organic traffic#and revenue generation. Their impressive portfolio of satisfied clients serves as a testament to their prowess as the best SEO worker in Ba#Continuous Improvement: In the dynamic landscape of SEO#adaptation is key to staying ahead. [Insert Name] is committed to continuous learning and refinement#constantly refining their skills and strategies to stay at the forefront of industry best practices.#In conclusion#[Insert Name] stands as a shining beacon of excellence in the realm of SEO in Bangladesh. Their unw

3 notes

·

View notes

Text

Bestie, I just finished a MASSIVE portfolio overhaul! ✨ rawbherb.art

Take a look! Feedback much appreciated! 💝

#portfolio#I optimized it for the busy viewer who only looks for 1-2 minutes#so everything is short and puts the best work first#Also added a few pages for 3D environments I AD'd#to shut up the employers who keep rejecting me for not having 3D experience lol

4 notes

·

View notes

Text

#Web Designing Services#Custom Website Designing#Website Maintenance Services#Landing Page Web Designing#Portfolio Website Designing#Blog & News Website Designing#Dynamic Website Designing#Web Application Development#eCommerce Web Development#Mobile App Development#Custom CMS Development#CMS Web Development#Multi Vendor Ecommerce#Business Branding Services#Brand Development & Strategy#Brochure Designing#Logo and Brand Designing#Company Profile Design#Video Production Services#Market Place Cataloging#Digital Marketing Services#Search Engine Optimization#Social Media Marketing#PPC Ads Services#Web Page Speed Optimization#Content Marketing Services#Google My Business Promotion

0 notes

Text

Exploring Core Functions of Modern Portfolio Management Companies

Modern portfolio management firms are in the intersection between quantitative analysis and strategic asset allocation, fundamentally shifting the way both institutional and high-net-worth investors approach wealth preservation and growth. These companies go much beyond simple asset management, through sophisticated risk models, factor investments, and rebalancing that dynamically optimize for performance across various market cycles.

Strategic Asset Allocation and Optimization

Strategic asset allocation, in turn, forms the bedrock of professional portfolio management. World-class portfolio management firms utilize leading-edge optimization techniques such as Black-Litterman modeling and Monte Carlo simulations to create portfolios with maximal expected return, operating strictly within narrowly defined risk parameters. It provides the quantitative basis from which the managers move away from diversification through simplistic, low-risk returns towards complex correlation analysis and hedging tail risk strategies.

Evolution of Factor-Based Investing

The operations of wealth management firms have evolved to focus more on factor-based investing approaches. Investment Portfolio management now break down opportunities through multiple lenses, such as value, momentum, quality, and size factors, to construct portfolios that capture specific risk premia while maintaining desired exposure levels. More accurate risk management and performance attribution are made possible by this granular approach to portfolio development.

Alternative Investments and Risk Management

The way that investment portfolio management handles alternative investments has advanced. Portfolio management companies can now easily incorporate real assets, absolute return, and private equity strategies into client portfolios in addition to the conventional stock and fixed-income proportions. This expansion into alternatives requires deep expertise in illiquidity premium evaluation, vintage year diversification, and complex fee structure analysis.

This includes all the various dimensions of the risk management framework in sophisticated portfolio management firms. Stress testing scenarios, value-at-risk analysis, and dynamic correlation models allow managers to gain insight into how portfolios will react under different conditions. Currency exposure management, for instance, involves consideration of counterparty risk evaluation, as well as systematic rebalancing protocols.

Execution Strategies and Performance Attribution

In executing their investment strategies, leading wealth management firm practitioners leverage advanced execution algorithms and dark pool access to minimize market impact and transaction costs. TCA and optimal execution strategies have become crucial for preserving alpha, especially in large portfolio adjustments.

Portfolio management firms have also transformed performance attribution and reporting. Modern analytics platforms allow for granular decomposition of returns across factors, sectors, and strategies, providing unprecedented transparency into portfolio behavior. Detailed attribution analysis can help managers identify sources of alpha, optimize factor exposures, and refine investment strategies with precision.

Technological Infrastructure and Key Considerations

The technological infrastructure that supports portfolio management has evolved to include artificial intelligence and machine learning applications. These tools enhance traditional quantitative models by identifying subtle market patterns, optimizing trade execution, and improving risk forecasting accuracy.

Several crucial elements to consider are as follows:

The investment philosophy of the firm and its alignment with academic research

Risk management infrastructure and stress testing capabilities

Experience in managing complex, multi-asset class portfolios

Track record across different market environments

Transparency in performance attribution and fee structures

Regulatory Environment and Future Outlook

The regulatory environment continues to shape how portfolio management firms operate, with an increased emphasis on fiduciary responsibility and risk oversight. Leading firms maintain robust compliance frameworks while adapting to evolving regulatory requirements around derivatives exposure, leverage limits, and risk reporting.

As markets continue to grow increasingly complex and interdependent, portfolio management firms will play an even more critical role. Their capacity to combine both quantitative rigor with strategic insight and robust risk management frameworks provides the institutional and individual investor with sophisticated solutions for navigating the global markets. A partnership with a portfolio management firm, which demonstrates both technical expertise and strategic vision, can be a step toward achieving investors' long-term financial objectives while optimizing their outcomes.

#portfolio management#investment strategies#asset allocation#risk management#financial planning#diversification#portfolio monitoring#investment solutions#transparency#modern portfolio#market trends#financial growth#portfolio rebalancing#ethical investments#personalized finance#wealth management#investment goals#advanced technology#market analysis#portfolio optimization

1 note

·

View note

Text

AI Trading

What is AI and Its Relevance in Modern Trading? 1. Definition of AI Artificial Intelligence (AI): A branch of computer science focused on creating systems capable of performing tasks that typically require human intelligence. These tasks include learning, reasoning, problem-solving, understanding natural language, and perception. Machine Learning (ML): A subset of AI that involves the…

#AI and Market Sentiment#AI and Market Trends#AI in Cryptocurrency Markets#AI in Equity Trading#AI in Finance#AI in Forex Markets#AI Trading Strategies#AI-Driven Investment Strategies#AI-Powered Trading Tools#Artificial Intelligence (AI)#Automated Trading Systems#Backtesting Trading Models#Blockchain Technology#Crypto Market Analysis#cryptocurrency trading#Data Quality in Trading#Deep Learning (DL)#equity markets#Event-Driven Trading#Explainable AI (XAI)#Financial Markets#forex trading#Human-AI Collaboration#learn technical analysis#Machine Learning (ML)#Market Volatility#Natural Language Processing (NLP)#Portfolio Optimization#Predictive Analytics in Trading#Predictive Modeling

0 notes

Text

Bento Prepped Design System

The Bento Box Prepped System is an innovative solution designed to streamline digital asset management and improve workflows. As a digital creative and product designer, I created this system to address challenges in asset organization, version control, and collaboration. Inspired by the traditional bento box, it organizes files hierarchically to ensure high-quality layouts, consistent image optimization, and brand elevation. Built-in Figma and focused on UI/UX principles, the system uses standardized naming, version tracking, and a traffic light system to improve transparency and efficiency. By reducing production time and enhancing collaboration, the Bento Box Prepped System empowers teams to deliver visually impactful work that drives brand growth. Full Project

#Digital creative#Product designer#UI/UX design#Creative technology#Image optimization#High-quality layouts#Brand elevation#Digital advertising#Product design trends#Innovative design solutions#Design portfolio#Creative tech solutions#Visual design#Figma#Creative branding

0 notes

Text

VALTITUDE DEMAND ANALYTICS

Under the six-sigma DMAIC approach, measurement of your current state is a key requirement for diagnostic, design and implementation of the process. Even for on-going process stability, measurement is critical.

The Demand Analytics module provides key insights on your planning performance and provides an insightful view of demand volatility, demand visibility and product mix analysis. It also provides additional insights on comparisons to the budget and annual plan.

Our Clients have reported improved Demand visibility, forecast accuracy and higher adoption of the S&OP process throughout the organization.

To know More, Visit Us:

#Valtitude#Demand Planning#S&OP Forecasting Consulting#Supply Chain Management Software#IBP#Supply Chain Optimization#Forecasting Consulting#Demand Modeling#Demand Sensing#valtitude#What is demand planning and its importance#APS#SAP SCM APO#Solutions Tuning#Re-implementation#SAP IBP#integrated business planning#model tuning#Product Portfolio Management#SCM planning#PlanVida#Planning#Analytics#Demand Planning & Forecasting Workshop#demand planning workshop in India#Forecasting Workshop in India

0 notes

Text

We improve the usability and adoption of all major planning systems. On completion of a usability project, you can expect to have much better demand forecasts and finished goods plans.

We have repaired and re-engineered complex and unusable implementations. Such re-implementations may range from minor system tweaks to system enhancements with model tuning to major re-implementations.

After the reenginnering project, we continue to support our clients who have a thriving SAP landscape. We provide:

Complete Implementation and Re-implementation services

Model Tuning and Algorithm Optimization for Demand, Inventory and Supply in SAP IBP

Support to maintain your SCM planning Views, Macros, Alerts and Process Chain Cycles

Continuous support for IBP Implementations

#Product Portfolio Management#SAP IBP#SCM planning#Valtitude#Demand Planning#S&OP Forecasting Consulting#Supply Chain Management Software#IBP#Supply Chain Optimization#forecasting#supplychainvisibility#supplychainmanagement#advancedplanning#realtimeplanning#sapcloud#inventoryoptimization#digitalsupplychain

0 notes